Would you rather have a Bored Ape NFT or a Burj Khalifa token?

Tokenization and NFTs have more differences than it seems. Because, unlike coins and tokens, tokenized assets are based on something real. And when combined with NFTs, possibly more valuable than physical assets.

How are these different from NFTs? What does tokenization even mean? Let’s find out.

What Is an NFT?

Non-fungible tokens are blockchain contracts with limited supply where each token has different values. Unlike cryptocurrencies, NFTs represent digital assets rather than currency. And instead of explorers like Etherscan, we use NFT marketplaces like Opensea.

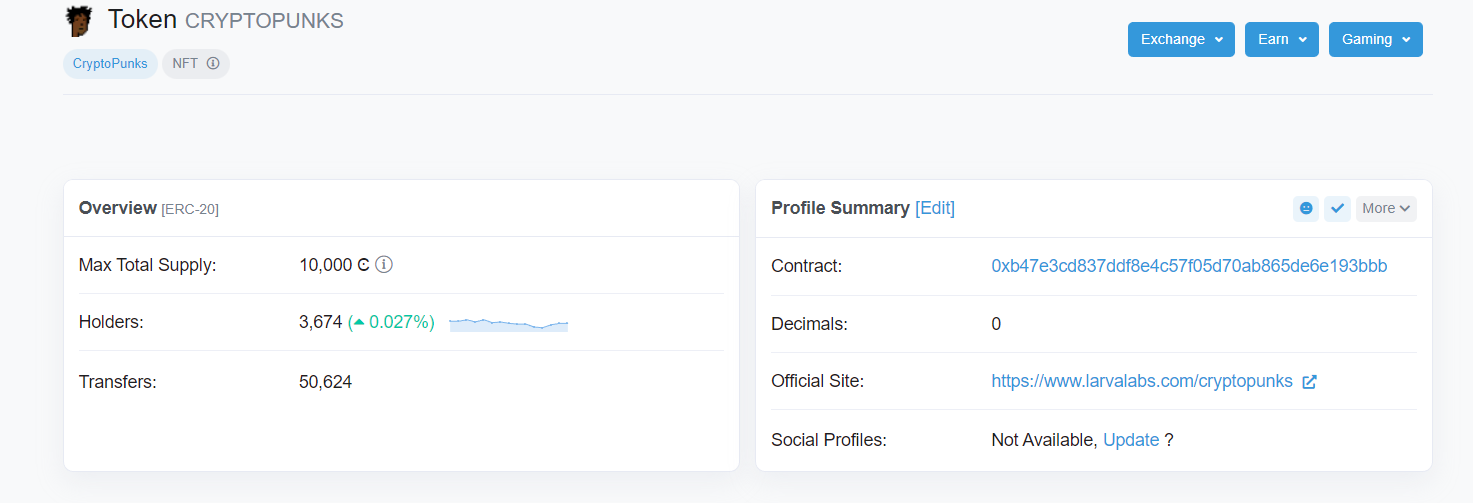

This is what NTFs look like:

Cryptopunks (June 2017) is the first popularized NFT collection on the Ethereum blockchain. Each cyberpunk belongs to the same contract under a different ID, each with different values. For example, this contract has a supply (or collection size) of 10,000 NFTs:

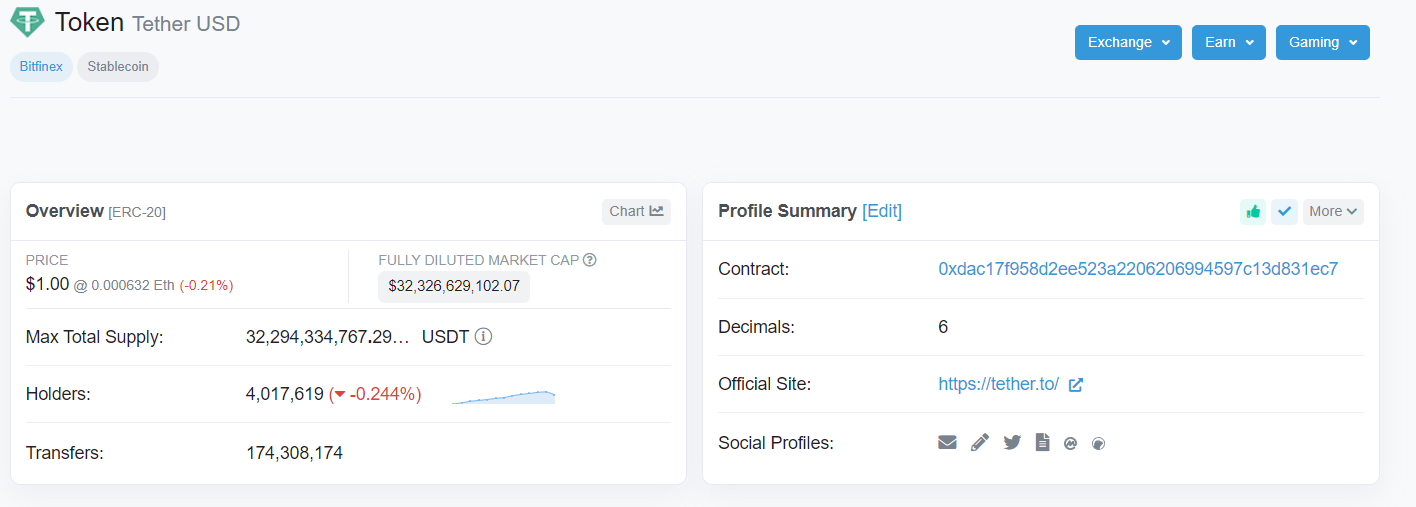

By contrast, fungible tokens like USDT have 32B:

If you have 1 USDT, it doesn’t matter if it’s the 1st USDT or the 31,485,247,357th. 1 USDT equals 1 USDT, but not with NFTs. If someone has Cryptopunk no.1, you might not be able to buy it even if you owned the other 99,999.

It’s worth whatever the owner resells it for, and only if he decides to sell it.

Then, the NFT owner has to wait for someone else to accept the trade or make a bid. If it’s too high or worthless, no one will buy it. That’s why there are no “NFT exchanges” or “NFT liquidity pools:” there’s no liquidity.

How do you sell NFTs? Either with perceived value (digital art) or utility. The main NFT use case is proof-of-ownership, which is valuable for creating digital economies on video games, online stores, or Web3 services. As for 2023, NFTs are like Ethereum in 2015: experimental and speculative.

What Is Blockchain Tokenization?

Tokenization is a term from data security that’s similar to encryption. The difference is that encryption involves a mathematical key to generate and revert ciphertext. Instead, tokenization generates random text and then assigns it to data (typically one “token” per word), like a dictionary.

Thus, tokens allow computers to verify sensitive data without revealing or storing it.

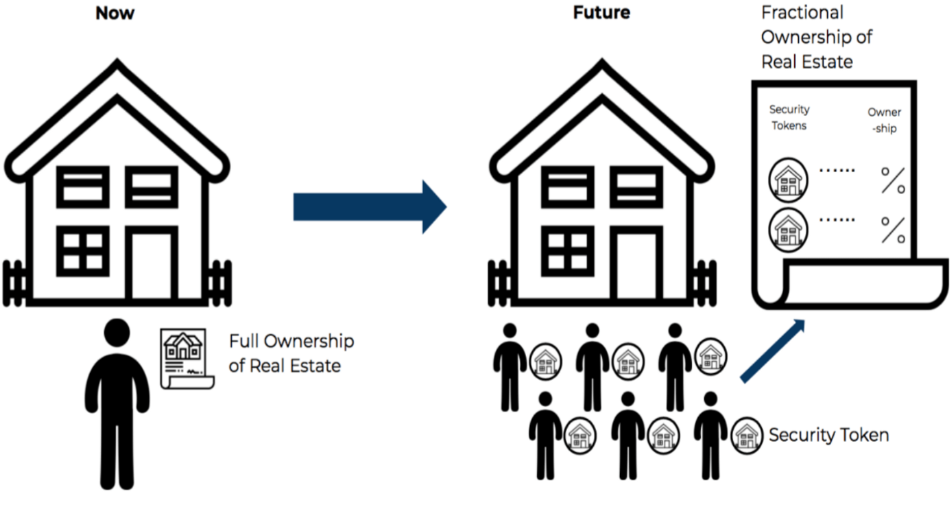

Crypto* tokenization is a secure system that represents one asset with another in the blockchain. They’re synonymous with fractional ownership, allowing multiple users to own “shares” of illiquid assets— NFTs, virtual land, even real estate. The second use case for tokenization is real asset transmutation.

(That means, tokens can be backed by real estate, precious metals, and such.)

Some tokenization examples are:

- Digital gold. For example, Paxos Gold has backed its tokens with physical gold and made them divisible.

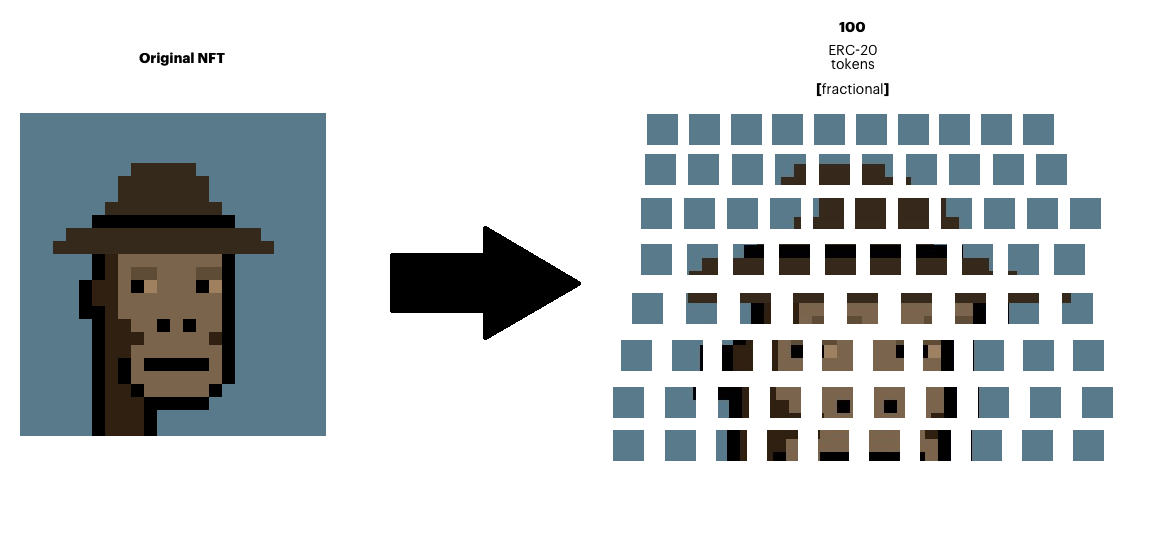

- Fractionalized NFTs. Some NFTs can share ownership among users, similar to security tokens.

For example, you could divide one NFT into a collection of 100 fragments (sub-NFTs), each with different owners or prices. A more complex alternative could be: whoever owns over 50% keeps the ownership rights, and everyone else is just an investor.

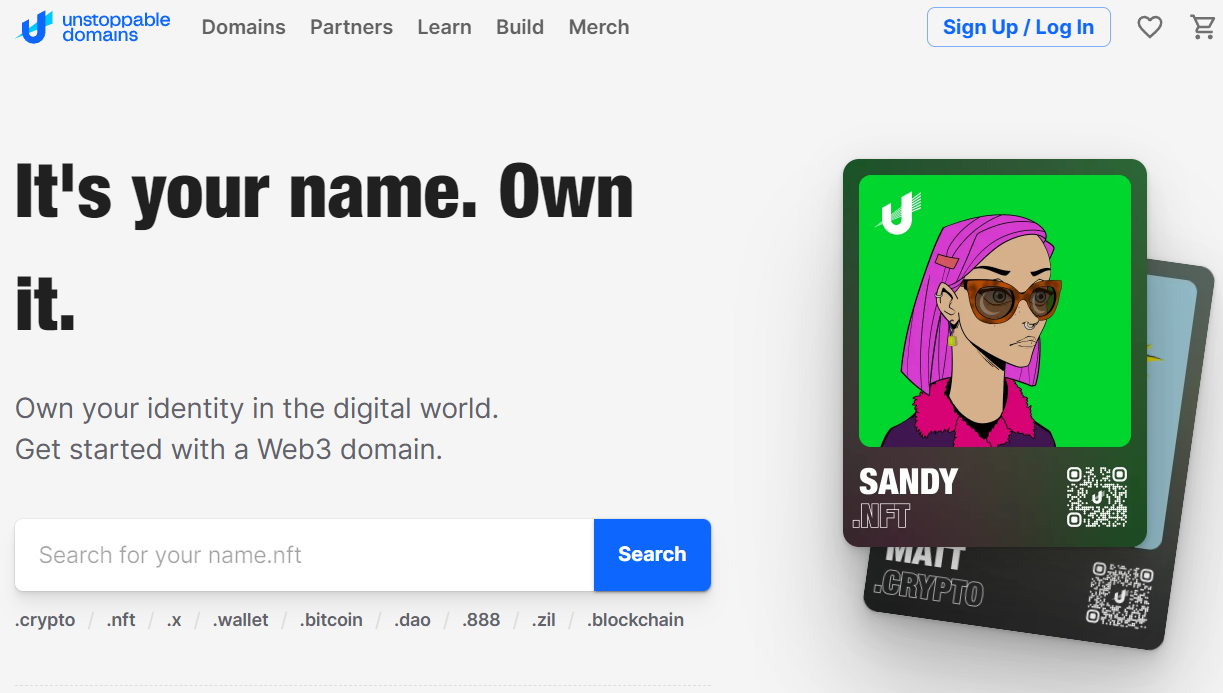

- Website domain tokenization. Tokenization applies both to traditional names and crypto domains like ENS (Ethereum Name Service). Domain flipping has come back, except the entry barrier is lower. Instead of buying one for $20,000, you can buy 10% and sell when it gains value.

- Real estate tokenization. NFTs have public records about who owns an asset, what they paid, how long they held, and everyone that did before them. Applied to real estate, NFTs can remove many steps involving trust, saving time and costs.

Differences Between NFTs and Tokenizing

Here are five differences between NFTs and tokenization.

#1 Fungibility

Fungible assets meet two conditions: they’re interchangeable and indivisible. Each token from the supply has equal value and can be broken down into decimals. E.g. With Bitcoin, 1 BTC = 1 BTC, and you can have 0.00514 BTC instead of one.

Tokenized assets are fungible. NFTs can be divisible when tokenized, but they’re still non-fungible. Just like NTFs have different rarities within their collection, NFT fragments also do. They’re non-interchangeable.

#2 Format

Tokenization involves off-chain assets, especially physical goods and services. This brings more interesting use cases than for NFTs, which are mostly virtual and based on perceived value. Tokenized assets are less speculative but still risky if anything happens to the real asset.

#3 Entry Barrier

Trading tokenized assets isn’t as easy. To list NFTs, you just get a Web3 wallet, visit a marketplace like Opensea, create a listing, make an offer, upload a picture, and publish. It’s fast and free.

For tokenization, you first need the underlying asset. Domains, real estate, precious metals, collectibles. Then, you need a platform that can verify your ownership and tokenize it. Every asset type has specific marketplaces while NFTs are all on one website.

#4 Integrity

You may own a blockchain asset, but do you control its value? That’s the problem with NFTs when they’re not backed by utility or real assets. It’s easier to find intrinsic value in tokenization.

Would you rather own a Cryptopunk or a tokenized Empire State?

Imagine the creator— without warning— increases the supply ten times. Now there are 100K Cyberpunks instead of 10K, and your NFT lost value. But if there were 10K Empire State tokens and now there are 100K, the property valuation is still the same. Except there’s room for more investors.

#5 Ownership Rights

Ironically (in 2023), NFT owners don’t really own anything. “Owning a picture” does lead to bigger offers in the marketplace, but it doesn’t control what anyone does with the asset. It’s public property.

With tokenized assets, not so much:

- If you own all property tokens, nobody else can list, claim, or use it.

- Buying tokenized precious metals makes them unavailable for trade to someone else (in theory). You have to either make an offer, wait for someone to sell, or claim it by buying tokens.

- A tokenized digital product or software only allows its holders to monetize it. For tokenized services, you grant or revoke access via subscriptions (e.g., ENS).

What’s More Important, Tokenization or NFTs?

Both NFTs and tokenization achieve trustless proof of ownership. The former is the most popular due to its low entry barrier and marketplaces. The latter has more real-life use cases and is still under development.

Will NFTs gain more utility? Will tokenized assets become more accessible? That’s why it’s important to watch both. Tokenized NFTs already exist but are far from mass adoption.NFTs are the most volatile marketplace since memecoins, which appeals to traders and creatives. Tokenization is about security and digitizing wealth. Until we see a more developed Metaverse, tokenization is more relevant.