USD stablecoins are the backbone of the crypto market. It’s the main currency used to buy cryptocurrencies and provide liquidity. It’s why dollar stablecoins often have a higher trading volume than Bitcoin or Ethereum.

Take away those stablecoins, and the entire market could crash.

Now, one reason people buy cryptocurrencies is precisely to avoid the dollar risks. The bad news is, crypto markets aren’t an effective hedge against the dollar or traditional markets. However, cryptocurrency allows us to invest in assets that do offer that safety.

So, what are the different non-dollar stablecoins, and how do you redeem them?

Summary:

- Non-dollar stablecoins allow their holders to hedge against the world’s reserve currency and preserve wealth. They can be backed by other foreign currencies, cryptocurrencies, real assets, or even algorithms.

- Non-dollar stablecoins offer clear advantages over dollar ones, but their limitations aren’t so obvious yet. Non-dollar variants aren’t anywhere close in terms of trading volume, adoption, and liquidity.

- Whether these stablecoins succeed or not, they won’t replace USD stablecoins or even prevent a crash in case they collapse. Still, the most preferred assets to hold long-term are likely either cryptocurrencies or non-correlated stablecoins.

What Are The Non-Dollar Stablecoins?

Non-dollar stablecoins are those that maintain constant value relative to other assets or currencies besides the dollar. They could be used as a store of value or hedge against the dollar.

There’s both a strict and flexible way to classify non-dollar stablecoins.

The strict definition assumes no USD correlation while maintaining a stable price. That would include only stablecoins pegged to foreign currencies like the Japanese Yen (JPY) or Swiss Franc (CHF). This includes hybrid, algorithmic, crypto-backed, and fiat-backed stablecoins.

The flexible definition considers any “stablecoin” that fulfills the same purpose of storing value or hedging against the dollar. These don’t maintain a stable price always, so you could call them pseudo stablecoins:

- Commodity-backed tokens. Tokens backed by real assets are less correlated to USD, even though their prices change. Still, it’s unlikely that they devalue as much as the dollar did because there’s economic value in precious metals, oil, and agricultural products.

- Decentralized stablecoins not pegged to $1. These could still be considered non-dollar tokens while using dollar reserves as long as their allocation is low enough.

- Stablecoins backed by multiple foreign currencies, correlated or not.

- A hypothetical high-volume token that has minimal volatility (e.g., increases its price by ~5% per year) and no correlation with Bitcoin.

Now, let’s see why would want (or not) these stablecoins over the dollar ones.

Pros and Cons of Non-Dollar Stablecoins

There are at least three advantages over dollar-stablecoins:

- Non-dollar stablecoins are a better store of value.

As the leading currency, US dollars are meant to be spent and rarely saved, at least, directly. Goods and services tend to cost more dollars over time, so there’s no true “stability” in financial inaction.

If you prefer to stay away from the risks of trading cryptocurrencies, non-dollar stablecoins are still more secure.

- Non-dollar stablecoins are more accessible than the underlying currencies.

Buying foreign currency and commodities is easier than ever before. No need for off-shore bank accounts, physical metals, or brokerage platforms. Just as easy as it is to buy Bitcoin, you can buy the stablecoins that are backed by those assets.

The traditional market also offers similar investment options, but it’s still not as accessible as DeFi exchanges. You access them with a Web3 wallet, which takes minutes to set up, needs no verification, and doesn’t keep custody of your funds.

- Crypto-backed stablecoins still have a greater upside.

Cryptocurrency is often correlated with traditional markets. But cryptocurrencies don’t affect traditional markets as much as they influence crypto. Meaning that buying crypto or non-dollar stables at the market bottom has more upside than traditional markets.

Whether it’s the Ethereum Merge or the latest Bitcoin halving, the prices of most altcoins can increase several times, often creating a permanent, higher floor price. But despite the trillion-dollar market cap of crypto, even the most anticipated events may not move the stock market a single point.

If you hold dollars or stocks, you miss it.

Now, here are three major limitations of these stablecoin variants:

- Most non-dollar stablecoins follow the US dollar anyway.

USD is the world’s reserve currency. Very few currencies are non-correlated to the dollar, so it wouldn’t solve the problem to buy foreign-currency stablecoins.

As for crypto-backed tokens, even the largest cryptocurrencies share some correlation with traditional stock markets. Stocks have shown an inverse correlation with interest rates. Interest rates affect inflation, so indirectly, dollars also may influence crypto-based stablecoins.

Except for commodity-based tokens.

- Dollar stablecoins are far more liquid and tradeable.

Regardless of what stablecoin is best, USD remains the most widely accepted. The different non-dollar tokens are great alternatives to store value but they’re not standardized enough to act as currencies. For the same reason you don’t buy groceries with a gold bar, non-dollar tokens are going to see limited use.

For goods and services, sooner or later you would need to convert to dollars.

As for liquidity limitations, commodity-backed stablecoins are more affected than dollar ones. You can’t just “print” more oil or gold. Scarcity isn’t a bad thing, but it still limits stablecoin adoption and trade.

- There aren’t enough non-dollar stablecoins yet.

Most of the pros and cons of non-dollar stablecoins are hypothetical. There aren’t nearly as many examples as there are for dollar stablecoins, especially fiat-backed. Excluding small projects, there are at best two major competitors for the different variants (gold, foreign currency, cryptocurrency…).

Dollar stablecoins might seem more problematic simply because they’ve been around for longer. Non-dollar types haven’t been as widely used, with most of their risk probably yet unknown. It’d be too optimistic and inaccurate to compare them with dollar stablecoins this early.

Examples Of Non-Dollar Stablecoins

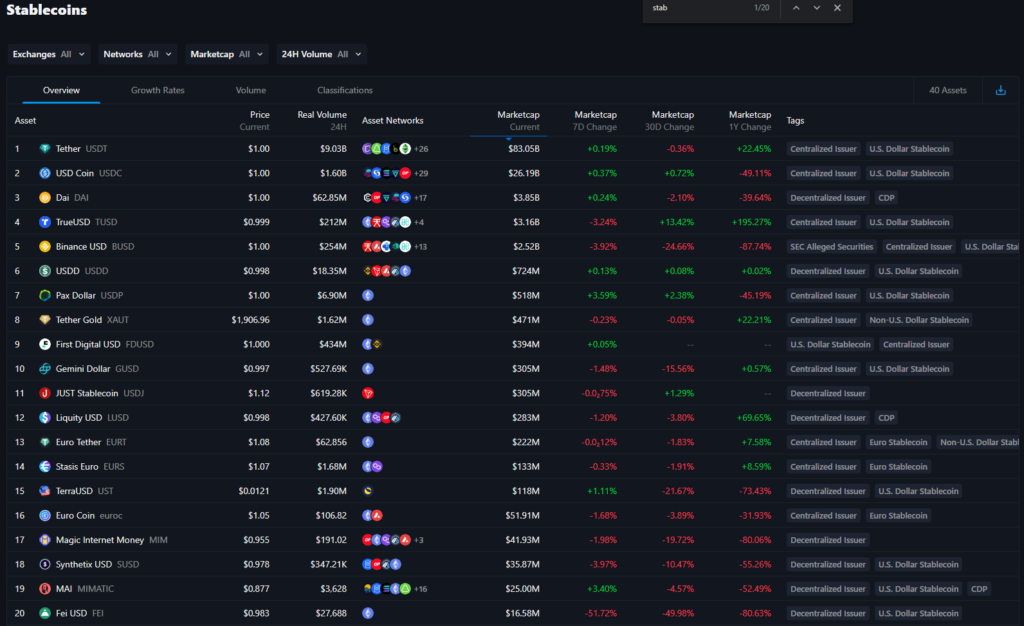

Based on the flexible definition, here’s an overview of the top non-dollar stablecoins as of 2023:

- Liquity USD (LUSD) is one of the few and largest stablecoins that are actually backed by crypto rather than other dollar tokens. It’s an ERC-20 token backed by Ethereum with a minimum collateral of 110%. Unlike fiat-backed dollars, LUSD is governance-free, immutable, and non-custodial. Except for a few 5% spikes, Liquity USD has kept the dollar peg since its launch in 2021, especially when the top three stablecoins lose it.

(The Liquity fork Liquid Loans (USDL and LOAN) is also tradeable on the new PulseChain Mainnet, a long-anticipated Ethereum hard fork.)

- Paxos Gold (PAXG) is a top-choice digital token to hedge against crypto and fiat currency.

There are +260,000 PAXG tokens backed 1:1 by troy ounces (worth ~$2,000 in 2023). Some selling points are: NYDFS regulated, no custody fees, instant on-chain redemption, low minimum purchase (~$20), monthly audits, available international shipping, and client assets held by a Trust company (not Paxos).

- Tether Gold (XAUT) was launched in 2020 by TG Commodities Limited. XAUT is as widely used as PAXG, with a supply of 246,000 and $5M of average 24h volume. While gold custody is free, both the deposit and withdrawal have minimum conditions and fees. If you like to buy gold from the same company issuing the no.1 dollar stablecoin in the world, XAUT might be for you.

- Crypto Franc (XCHF) represents over three million Swiss Francs that are 1:1 backed and redeemable. Users can trade as little as 100 CHF with XCHF, ETH, USDC, and other ERC-20 tokens. Alternatives include Centi Franc (CCHF), DeFi Franc (DCHF), and jCHF.

- Digital JPY (GYEN) is a fiat stablecoin backed 1:1 by yens, now over ¥2B. It was launched by the Internet Giant GMO in 2021 along with ZUSD, becoming the first regulated JPY token (like GUSD in the US). GYEN is tradeable on Ethereum and Stellar Network.

- AGX Coin (AGX) and Silver Token (SLVT) are silver-backed tokens that respectively launched in 2022 and 2017. Despite their low liquidity, they both offer physical silver on request. AGX is an Avalanche token for the price of one silver gram, and SLVT is an Ethereum token worth one per ounce.

Some of these have very low liquidity. It’s recommended to wait for the non-stablecoin market to evolve for a safer investment.

If you want to include correlated dollar alternatives, there’s also the Australian Dollar Token (AUD), Euro Coin (EUROC), Stasis Euro (EURS), Singaporean Dollar (XSGD), Indonesian Rupiah (XIDR), and British Pound (GBPT) stablecoin.

The Future Of Non-Dollar Stablecoins

Despite its questionable stability, USD is one of the most adopted currencies for trading and measuring the economy. But for how long? Definitely not forever, and you don’t want to be holding dollars when that happens.

Instead, you can hold tokens backed by commodities, foreign currencies, or blue-chip cryptocurrecies.

Crypto allow us to conveniently hold alternative currencies and also effortlessly convert them to dollars. All while offering full control of your finances with the potential upside of Bitcoin and altcoins. Unless you specifically need dollars to trade, spend, or invest, there are far better options than the (centralized) big three stablecoins.